- The Ipon Challenge

- Posts

- 🐾 Thinking of Adopting? Here’s What It’ll Cost You

🐾 Thinking of Adopting? Here’s What It’ll Cost You

They’ll fill your heart and empty your wallet. Here’s how to prepare for both.

Getting a pet always starts out as a heart decision. You picture yourself coming home to a wagging tail or a sleepy cat stretching on your lap after a long day. But somewhere in between that daydream and the trip to the adoption center, there’s a very grown-up question: Can I actually afford this?

Pets are emotional therapy and financial responsibility rolled into one. They’ll make your life fuller, yes, but they’ll also make your wallet a little emptier each month. And you can’t just opt out when things get expensive or inconvenient.

In today’s edition, we’ll go over:

The Real Cost of Pet Ownership in the Philippines

How to Prepare your Wallet for a Pet

TLDR;

The Bottom Line

Pets can change your life but they’ll change your budget too. They bring joy, comfort, and routine, but they also come with long-term financial responsibility.

The costs add up. Food, vet care, grooming, travel. Expect ₱30,000–₱100,000 a year depending on your pet’s needs and your lifestyle.

Prepare your wallet first. Build a pet fund, check your cash flow, and plan for vet visits and travel costs before saying yes.

It’s not about saying no to pets. It’s about saying yes responsibly.

The content

Why It’s Still Worth It

I won’t pretend it’s all numbers. Having a pet brings a kind of joy that’s hard to measure. A lot of studies and real stories show how pets help people with stress, loneliness, and even depression. They add structure to your days. They make you care about something outside yourself.

Giphy

And that’s why, for many of us, the trade-off feels fair. The costs are financial, but the rewards are emotional. And if you’re in a good place to manage both, it’s one of the best investments you can make in your own mental health.

💸 The Real Cost of Pet Ownership (Philippine Context)

Let’s get real with the numbers.

One-time costs:

Adoption or purchase: ₱5,000–₱15,000+ (depending on breed or adoption center)

Neutering/spaying: ₱1,500–₱6,000

Starter gear (crate, leash, bowls, bed): ₱1,000–₱5,000

Monthly basics:

Food: ₱1,000–₱5,000

Vet visits and meds: ₱500–₱2,000 per check-up

Grooming and hygiene: ₱500–₱1,000

Vitamins and treats: ₱300–₱800

Ad-hoc costs:

Pet hotel or sitter when you travel: ₱500–₱1,500/day

Emergencies or surgeries: ₱5,000–₱20,000+ in one go

If you do the math, owning a pet can easily run anywhere from ₱30,000 to ₱100,000 a year depending on breed, size, and how much you like to spoil them.

Actionable Tips for You

The Responsibility Part

A pet isn’t a subscription you can cancel when you’re tired. It’s a 10- to 15-year commitment. They rely on you entirely for food, safety, healthcare, affection. And while the love is mutual, the responsibility isn’t shared.

So before you get one, ask yourself: can I keep showing up for them when life gets busy, expensive, or inconvenient?

How to Prepare Your Wallet for a Pet

Build a pet fund.

Treat it like an emergency fund just for them. Save at least three to six months’ worth of expenses (around ₱10,000–₱20,000). Vet bills and travel costs are easier to handle when you know where the money will come from.Check your cash flow.

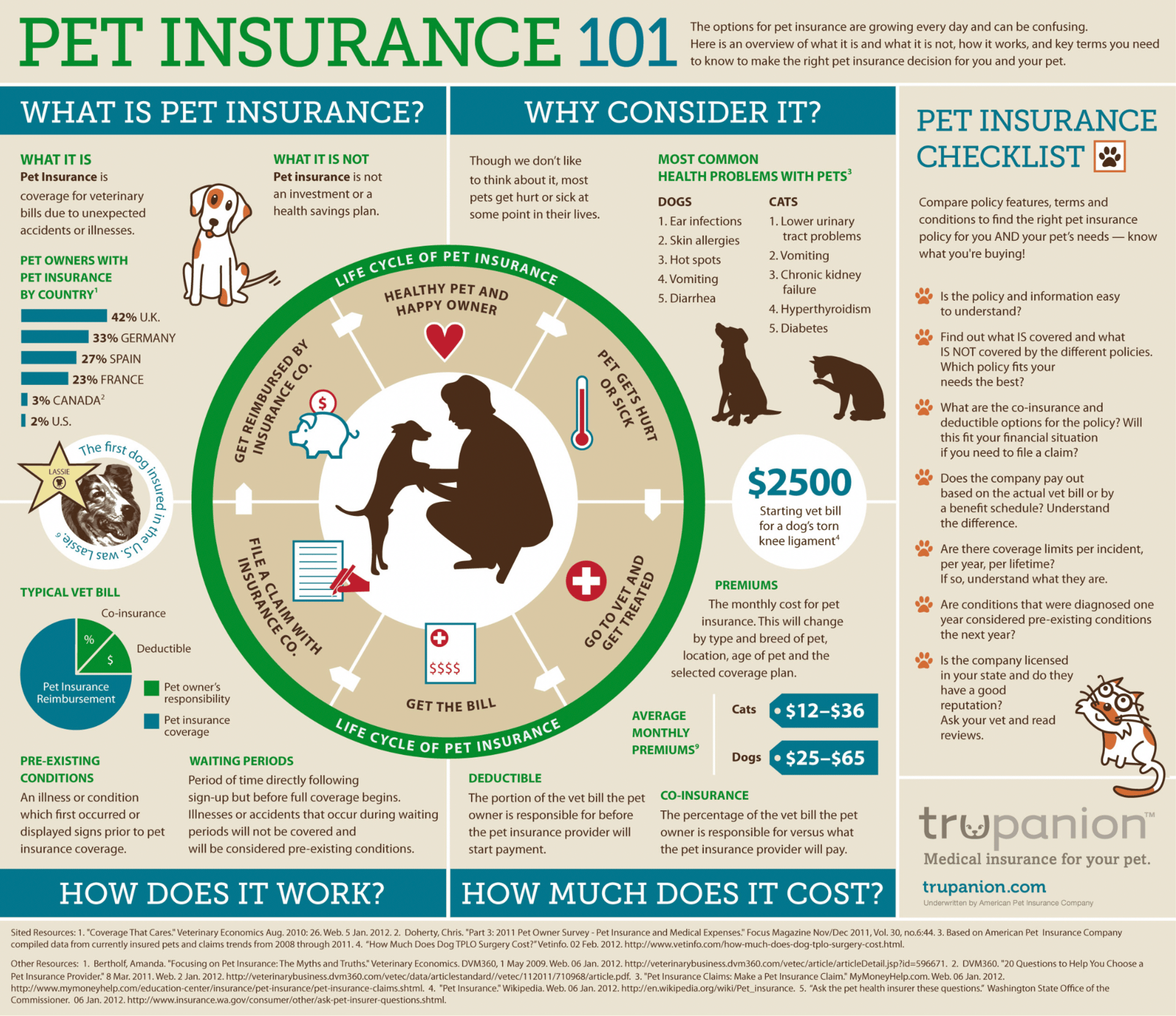

See if you can realistically add ₱2,000–₱5,000 in monthly expenses without touching your savings or debt payments. If the math doesn’t work yet, don’t feel bad for waiting until it does.Look into pet insurance or prepaid vet plans.

Some clinics offer prepaid veterinary cards or basic insurance for as low as ₱500/month..

Source: trupanion.com — good overview of what Pet Insurance is

Plan for travel.

If you travel a lot, factor in pet hotels or sitters. Don’t assume friends or family will always be available. Having a plan saves everyone stress.Start small.

If you’ve never owned a pet before, maybe start with an adoption or a low-maintenance one. It’s a way to learn the rhythm and cost of ownership.

Some Honest Thoughts

Getting a pet isn’t financially irresponsible. What’s irresponsible is saying yes before you’re ready.

I think about it this way: pets are therapy in fur form. They’ll teach you to slow down, to be patient, and to love without conditions. But they’ll also teach you to budget, to plan ahead, and to grow up in ways you didn’t expect.

Stuff Worth Sharing

The Link Lowdown

How Does Pet Insurance Work? - a comprehensive take on Pet Insurance

Pet Insurance Basics: What is it and why do you need it? - a more basic intro of what Pet Insurance is