- The Ipon Challenge

- Posts

- ⭐ 5 Money Lessons I’m Bringing Into the New Year (And You Should Too)

⭐ 5 Money Lessons I’m Bringing Into the New Year (And You Should Too)

Your spending tells a story. Learn 5 lessons to fix habits, stop repeat mistakes, grow savings, and protect your money in 2026.

The Start of Our Three-Part Year-End Series

We’re doing something a little different to close out the year. This week’s newsletter is the first drop in a three-part series designed to help us enter 2026 with more clarity and intention around our money.

And this first part is all about reflection. Before we review numbers or set goals, we have to look back at what this year actually taught us. Reflection is the foundation. You can’t change what you don’t understand, and you can’t plan ahead if you haven’t made sense of the year you just lived.

So here are the lessons I’m taking with me into the new year.

In today’s edition, we’ll go over:

5 Money Lessons I’m taking with me to 2026

TLDR;

The Bottom Line

Your spending tells the truth about who you are, whether you admit it or not. This week’s reflections cover five lessons:

Your purchases reflect your values more than your intentions.

Financial mistakes are tuition. Use them once.

Small, consistent actions beat dramatic resets every time.

Income growth is meaningless if your lifestyle inflates with it.

Protecting your money (insurance, emergency funds, buffers) matters just as much as growing it.

Next year is about aligning money habits with the person you’re trying to become.

The content

5 Money Lessons I’m taking with me to 2026

1. How you spend your money is a reflection of who you are.

Source: Dreamstime

Think about everything you own – your clothes, your phone, your abubots – all of those used to be money.

Your spending is a mirror. It shows your habits, your values, your impulses, and sometimes even your insecurities. You can say you care about growth, but if you spend more on random cravings than on books, courses, or rest, the mirror tells a different story.

Next year, I want my spending to align more with the person I’m trying to become, not just the person I am in moments of stress, boredom, or comparison.

Money is a tool, but it’s also a language. And it’s worth asking:

What story is my money telling right now? And is that the story I want?

2. Every mistake is the cost of learning, but you shouldn’t pay the same cost twice.

I’ve had my share of questionable decisions (bad investments, unnecessary purchases, etc.). And, I held onto guilt longer than necessary.

But I’ve learned to stop beating myself up over financial mistakes because the shaming doesn’t help. What helps is understanding why you made that choice, taking the lesson, and not repeating it.

Mistakes are okay. Repeating them is another story.

3. Small, consistent actions do more for your money than big, dramatic efforts.

I used to plan these huge financial resets (starting this month, I’ll save half my salary,” or “I’ll invest aggressively starting next quarter”). And those plans usually died after two weeks.

What actually worked are the small automations I did to make saving and investing easy and frictionless.

Money doesn’t respond to ambition but to consistency.

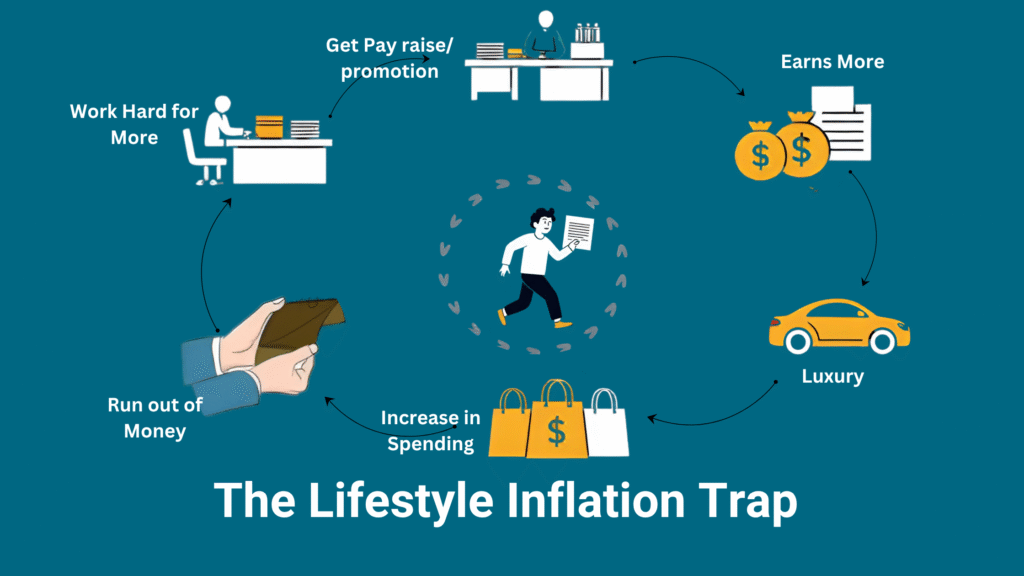

4. Earning more isn’t enough if your spending grows just as fast.

Source: Finquesty

There were months this year where my income grew, but somehow my savings didn’t. Your income moving up means nothing if your habits stay the same. What matters is the gap between what you earn and what you keep. That gap is where freedom starts.

5. Protecting your money is just as important as growing it.

2025 hit me like a huge dump truck. This year reminded me that protection matters too.

Insurance, emergency funds, risk awareness – all the things that feel unexciting but save you from total collapse when life inevitably happens.

Final Thoughts

The new year won’t magically fix anyone’s finances, but it does give you a cleaner mental slate to start from.

Next week, we’ll take this a step further and do a simple year-end financial review. Reflection is the first part; knowing where you actually stand is the second.