- The Ipon Challenge

- Posts

- 💳 Buy Now, Panic Later? The Real Deal with BNPL in the Philippines

💳 Buy Now, Panic Later? The Real Deal with BNPL in the Philippines

Curious about Buy Now, Pay Later in the Philippines? Learn the pros, cons, hidden fees, and when it's smart—or risky—to use BNPL apps like Shopee, Lazada, and BillEase.

Ever been tempted by that ₱500 lang today, 0% interest deal on Shopee or Lazada? You’re not alone.

Buy Now, Pay Later (BNPL) schemes are everywhere (from online shops to in-store deals) and they sound like the perfect solution especially when you’re short on cash. But is it actually a smart financial move?

Let’s break it down: the pros, cons, real examples, and 3 shocking truths you should know before tapping that Pay Later button.

In today’s edition, we’ll go over:

Pros and Cons of Buy Now, Pay Later (BNPL)

Common BNPL options in the Philippines

3 surprising truths of BNPL

TLDR;

The Bottom Line

BNPL is still utang: It’s tempting and convenient, but missed payments = high interest, late fees, and a damaged credit score.

Use it only for needs: If it’s 0% interest, fits your budget, and for essentials (not wants), it can be useful.

BNPL traps are real: Apps like Shopee, Lazada, and BillEase make it easy to overspend. Always read the fine print before you click “Pay Later.”

The content

The Pros of BNPL

Split payments into bite-sized chunks: Helps you buy bigger-ticket items without shelling out the full price at once.

0% interest promos: If paid on time, some deals genuinely cost nothing extra.

No credit card required: You can access short-term credit without applying for a traditional card.

The Cons of BNPL

Hidden interest and fees: If you miss a payment, expect annual interest rates of up to 15–25% or late charges.

Encourages impulse spending: It's easier to justify a want, not a need, when you only pay ₱200 today.

Debt snowball risk: Using multiple BNPL options across apps can leave you juggling due dates and buried in utang.

The Content (Part 2)

Common BNPL Options in the Philippines

Here are 3 popular examples used in the Philippines:

1. Shopee SPayLater

Source: Shopee

Interest rate: 1–5% monthly (12-60% annually)

Terms: 3, 6, or 12 months

Shocking bit: Late fees can be ₱100+ per cycle and may affect your credit score (yes, they report to credit bureaus).

2. Lazada Loan / LazPayLater

Source: Lazada

Interest rate: 3.5–4.5% monthly (42-54% annually)

Terms: 2–12 months

Caution: Once approved, it's very easy to keep borrowing even without noticing how much you’ve stacked up.

3. BillEase

Source: BillEase

Interest rate: ~3.49% monthly (up to ~41.88% annually)

Terms: Up to 12 months

Good to know: also provides 0% interest grace periods (Pay with Grace) with select merchants for 3-6 months. After the grace period, the standard 3.49% interest rate applies.

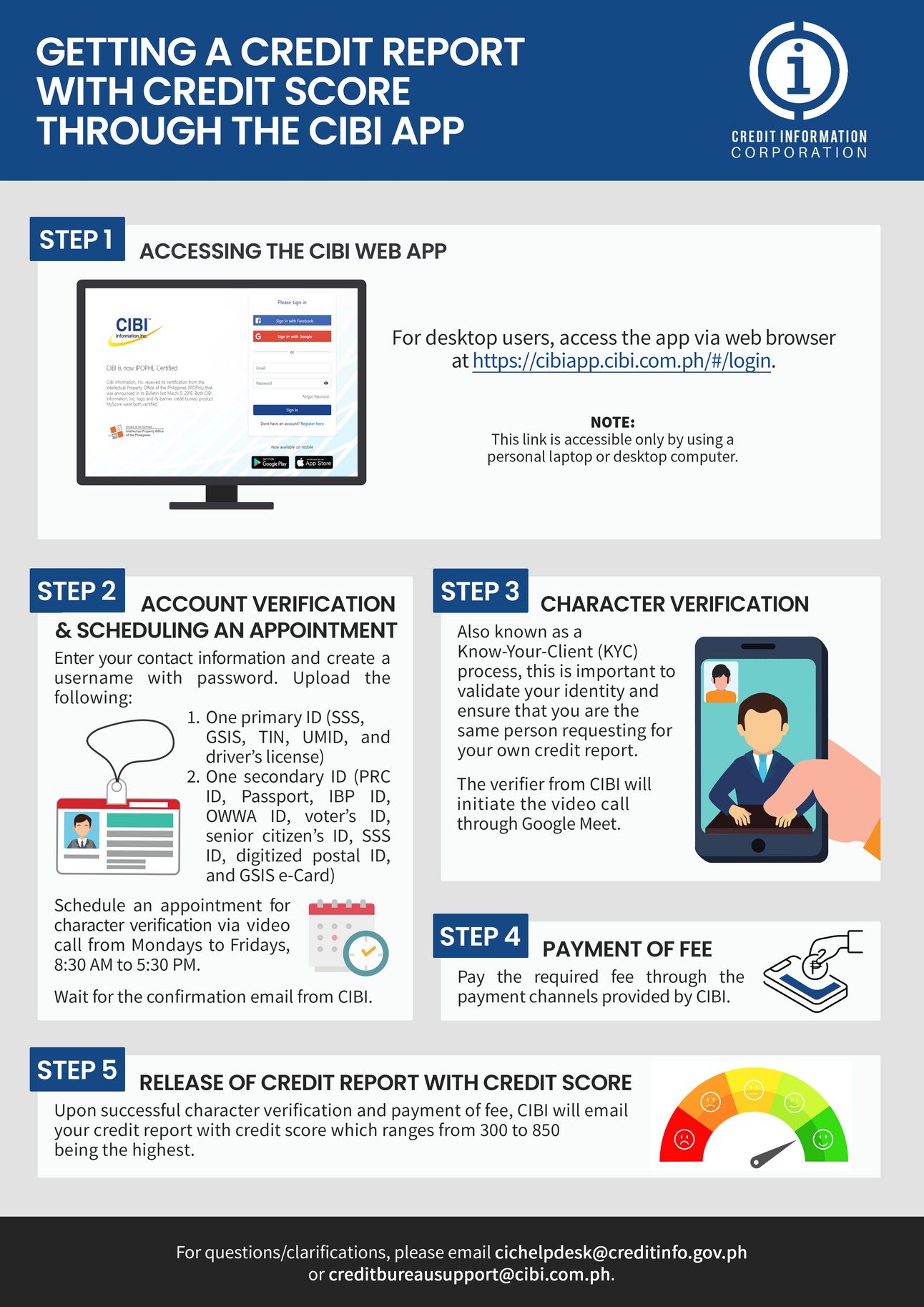

3 Shocking Truths About BNPL in the PH

It can ruin your credit score.

Missed payments are reported to CIC/CIBI and TransUnion, making future loans harder to get (check link/s below to know more about credit bureaus and your credit report)

Many “0%” offers still charge processing fees.

That ₱0 interest? Some sneak in ₱50–₱150 monthly “service fees” anyway.It’s becoming the new utang trap.

Some users stack 5+ BNPL accounts with no clear repayment plan—instant lifestyle inflation without salary growth.

Final Thoughts

BNPL can be a useful tool when used intentionally, but let’s not sugarcoat it: it’s still utang.

If you can’t buy it with cash, ask yourself: Do I really need this, or is it just the app talking?

Your financial peace > short-term dopamine hit.

Stuff Worth Sharing

The Link Lowdown

CIC Credit Report: FAQs regarding your credit report (includes who can access your credit data, whether or not you can clear your credit history, etc.). Interesting stuff

Credit Info List - shows the list of lending entities submitting credit data to CIC

Follow us on IG and Tiktok @myiponchallenge - we post cool stuff there too.