- The Ipon Challenge

- Posts

- Before You Swipe Abroad: Our Take About Travel Credit Cards

Before You Swipe Abroad: Our Take About Travel Credit Cards

Points, miles, fees, perks. Here are our top 3 travel credit cards for Filipino travelers.

In a previous issue, we talked about the best beginner credit cards. In this one, I thought it would be great to share our top 3 picks for travel credit cards.

If you’re like me, you love traveling (check out my tips on how to solo travel without breaking the bank). But let’s be honest: traveling now isn’t cheap.

That’s why this issue is about smart travel cards. Cards that earn points, waive or cut those annoying foreign transaction fees, toss you lounge access here and there, and can give you travel insurance.

In today’s edition, we’ll go over:

Our Top 3 Credit Cards

What to look out for before applying

How to apply

TLDR;

The Bottom Line

Top cards for us? BPI Visa Signature, Metrobank World Mastercard, EastWest Singapore Airlines KrisFlyer World Mastercard.

Check the real deal flows: FX fees, annual fees, reward types, lounge/insurance perks. Match them to your travel habits.

Apply smart: Meet income eligibility, use the card to unlock perks, and redeem wisely.

The content

What to Look Out For Before You Apply

Choosing the card is just the start. You’ll want to check:

Foreign transaction / FX fees: When you swipe abroad, many cards tack on ~2 %–3.5 % conversion fees. Travel cards that stay near 1.8 % or less are gold.

Annual fee & waiver conditions: Some cards waive the fee for the first year, or require a certain spend to keep it waived.

Earn rate & type of rewards: Miles vs points vs cashback. Do you redeem for flights/hotels? Make sure the reward aligns with your goal.

Perks vs actual use: Lounge access is nice, but only if you’ll actually use it. For travel insurance, check what it covers and whether your trip qualifies.

Your travel style: If you travel once a year domestically, maybe a heavy-luxury travel card isn’t worth it. Match card to your habits.

Our Top 3 Travel Credit Card Picks

Here are three cards that stand out right now for Filipino travelers:

Source: BPI FB Page

Why it works: Low foreign exchange fee (~1.85 %) and earns 2 BPI points for every PHP 20 spent overseas. Lounge access included. Highest travel insurance available: PHP 20M-40M

Barrier to entry: This is premium-tier so expect higher income requirement and annual fee (which may be waived depending on spend).

Why I like it: If you travel abroad a couple of times a year, this card gives you great perks.

Annual Fee: PHP 5,500 per year

Minimum requirement: PHP 1.2 million annual income

Source: Metrobank

Why it works: Earns 3× points on every Php 20 foreign currency spend. Includes global lounge passes and unlimited local lounge access in some cases.

Barrier: You’ll need to spend somewhat aggressively to truly maximize rewards, and know how the points work (convertible into miles or vouchers).

Why I like it: This one rewards actual travel spending rather than just local shopping disguised as travel.

Annual Fee: PHP 5,000 annual fee for principal card (subject to promos/waivers)

Minimum requirement: PHP 700k annual income; existing card requirement applies

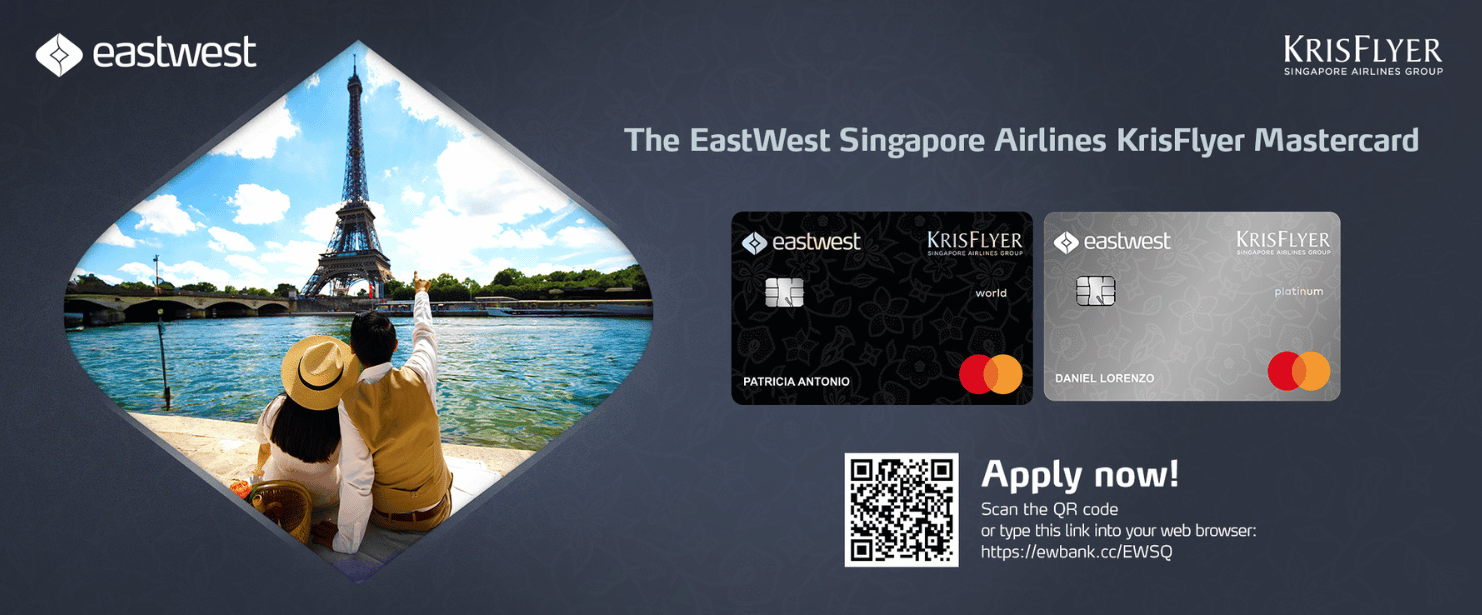

Source: Singapore Airlines

Why it works: Earns KrisFlyer miles on travel & overseas spending (1 mile for every PHP 12 on travel/forex spend). Lounge access and good travel-insurance benefits too (of up to PHP 20M). One of the lowest foreign exchange fees I could find (~1.7 %)

Barrier: Because it’s tied to the KrisFlyer miles program, you’ll get more value if you use the miles for Singapore Airlines or its partner network; and less value if you redeem them poorly.

Why I like it: It hits a sweet spot: solid travel perks + miles, yet not ultra-luxury tier.

Annual Fee: PHP 5,000 annual fee for principal card

Minimum requirement: PHP 1.2 million annual income

Actionable Tips for You

How to Apply & Prepare Before You Fly

Steps to get your travel card setup:

Check eligibility: income requirement (we’re talking a lot of travel cards need ₱500k+ annual) and age requirement.

Gather docs: valid ID, proof of income (tax returns/COE), active savings/investment account.

Compare annual fee + waiver criteria: If it’s PHP 4,000–PHP6,000 a year, ask: “Will I really get back more value than this fee?”

Use it right: To unlock lounge access or insurance, often you need to chip in your travel spending via the card (airfare/hotel) or register the benefit.

Track your miles/points: Having a card is step one. Knowing when and how to redeem (or if rewards expire) is just as important.